(Provident Personal Superannuation Plan)

This scheme is a cash accumulation scheme. The benefits payable by your scheme are guaranteed by the Government.

The earnings rate, declared by the Board, was 4.00% for the year ended 31 March 2025. Your scheme’s average annual earnings rate, over the last 10 years, continues to exceed the average annual rate of inflation. The investment return (after tax and expenses) earned by the scheme for the year ended 31 March 2025 was 4.78% (2024: 13.44%).

Number of cash instalments a member may receive in any one financial year

Your scheme allows you to take your Total Credit in cash instalments of an amount and frequency determined by the Board. Effective 1 April 2020, the Board increased the number of cash instalments a member may receive in any one financial year (1 April to 31 March) from two to four. The minimum amount of each instalment remains unchanged at $1,000 and the minimum account balance for the scheme remains at $5,000.

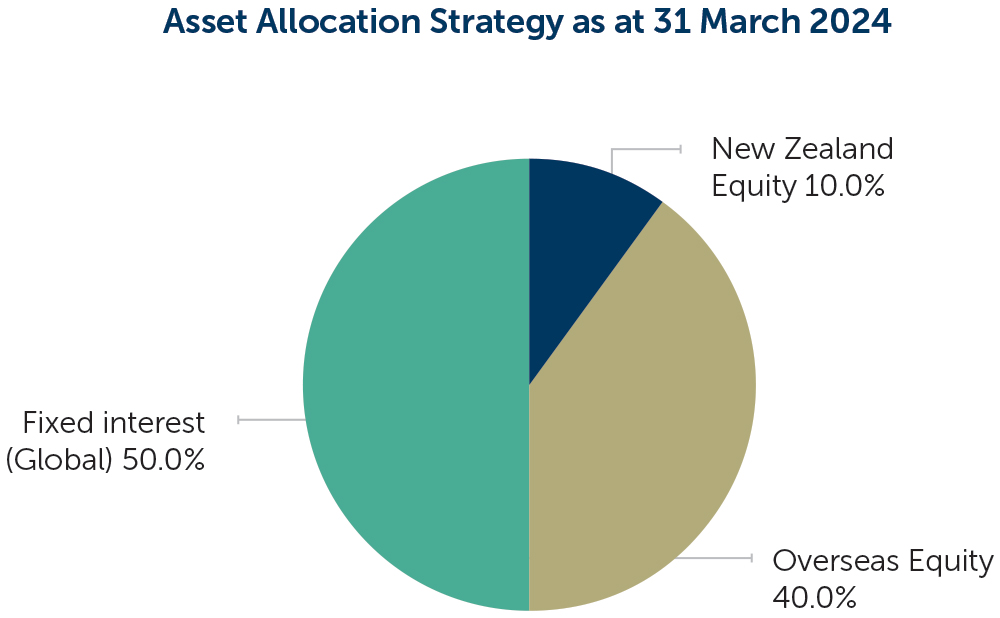

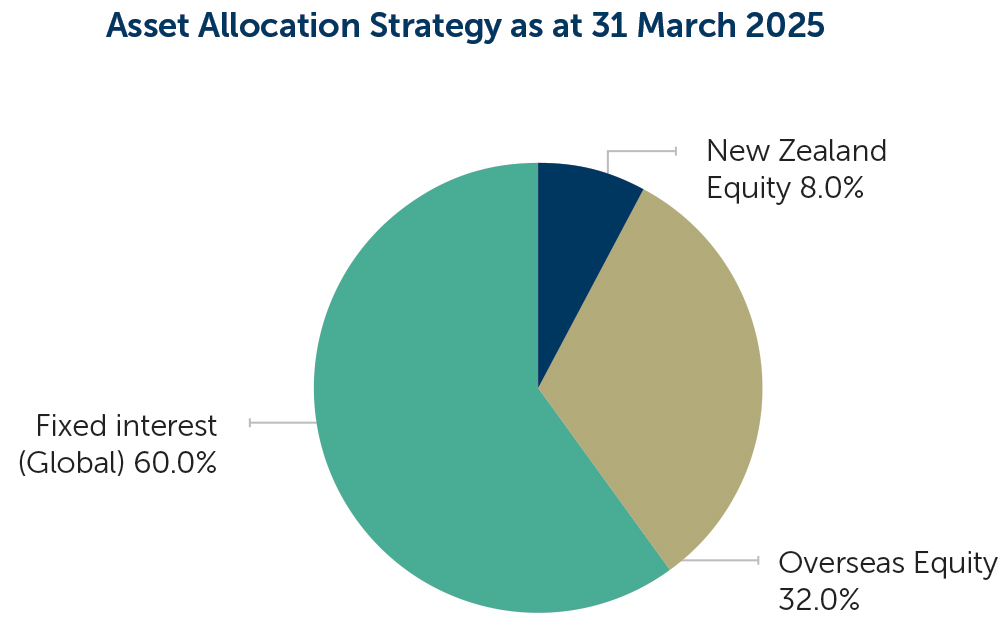

How your money is invested

The scheme's asset allocation strategy is set by the Board and reviewed regularly. In addition, from time to time the Board applies its Dynamic Asset Allocation (DAA) tilting programme as outlined in the Statement of Investment Policies, Standards and Procedures (SIPSP). The pie charts show the scheme's asset allocation strategy effective as at 31 March 2024 and 31 March 2025.

The scheme’s asset allocation was reviewed and changed by the Board on 14 August 2024. The new asset allocation, effective 2 September 2024 is shown above.